Last minute tax planning? Here is a quick guide!

Do you find yourself in a situation where there are just a bunch of days ahead for the deadline of submission of tax documents? Here is a quick guide to help you sort out your finances last minute!

- Target full utilisation of Section 80 C: Maximum deduction available is to the tune of Rs. 100,000. Assess your income to arrive at the amount you need to invest in this section. The investment avenues include; Public Provident Fund (PPF) up to Rs. 70,000, National Saving Certificate (NSC), Life Insurance or ULIP premium, tuition fees paid for children’s education (2 children max), Equity linked savings schemes (ELSS), Post office saving deposit (POSD) and five year fixed deposits with banks among others. For individuals in the higher income bracket, section 80 C which is the most popular one may not be sufficient to reduce overall tax liability. Here is where the other sections will play a key role in reducing tax outflow.

- Interest on home loan: Individuals intending to buy a house should consider opting for a home loan. Interest payments up to Rs 150,000 pa are eligible for deduction under Section 24

- House Rent Allowance (HRA): You can take advantage of this if you are renting an accommodation. There are set guidelines determining the amount deductible. Please note that the rent agreement and the rent receipts need to be submitted

- Health Insurance Premium: Annual deduction of Rs. 15,000 is permissible for self, spouse and dependent children. Also and additional Rs. 15,000 is allowed for parents

- Medical reimbursement: Medical treatment expenses up to Rs. 15,000 can be claimed annually as deduction from salary u/s 17(2). Actual bills need to be produced

- Donation to Charitable institutions: Subject to the stated limits, donations to specified funds/institutions are eligible for tax benefits under Section 80G. Receipt needs to be produced.

- Interest paid on educational loans: Deduction can be claimed on interest paid on educational loans taken for higher education of you, your spouse and children under section (u/s) 80 E. There is no limit on the amount of deduction you can claim. However, the loan should be taken for a graduate or post-graduate program in engineering, medicine or management or a post-graduate course in the pure or applied sciences

Points to remember

- Section 80 C allows deduction of tuition fees spent on children’s education

- If you want to pay rent to your parents or relatives (kindly note this arrangement cannot be done with your spouse), you will need to treat them as landlords and request the owner of the house to declare it in his/her personal income tax return

- The maturity proceeds of life insurance policies are not taxable

- Conveyance allowance up to maximum of Rs. 800 can be claimed per month as deduction from salary u/s 10(14)

- Long term capital gains on listed shares/securities are not taxable

- Capital gains on sale of house property can be avoided by purchasing another house property within two years after or one year before date of sale

- Stamp duty charges and registration charges paid while purchasing new house is eligible for tax deduction under Section 80 C

The first step in the direction of tax saving is to assess your tax liability. So start the process so that you can then decide on what all to opt for to save maximum taxes.

Do give this a thought!

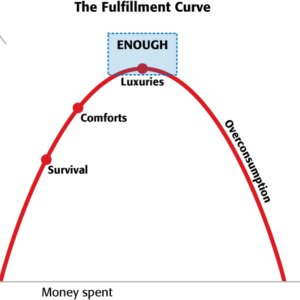

Tax incentives are given to encourage savings/ investments. Savings form part of your overall financial plan which in effect means tax planning is a subset of financial planning. Your financial plan will set objectives for you based on your aspirations, your life style, your age group, size of family etc. The question you need to ask yourself is, “Did you adhere to your financial plan while investing in an instrument for tax saving purposes?” Well if your answer to that is “yes”, then you’re moving in the direction of attaining your financial goals. If not, it’s time for you to take corrective action. The damage may have been done for the past year but the forthcoming is an opportunity for you to plan well. Remember, procrastination is the thief of time. So if you postpone it now, this year will be no different from the last one